Effective Date: January 27, 2026

Important Notice

This guide applies only to candidates enrolled in the CPA Certification Program in the Atlantic region: Bermuda, New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island. It does not apply to candidates covered under a Memorandum of Understanding (MOU). Separate transition guidance will be provided to MOU candidates in due course.

Overview

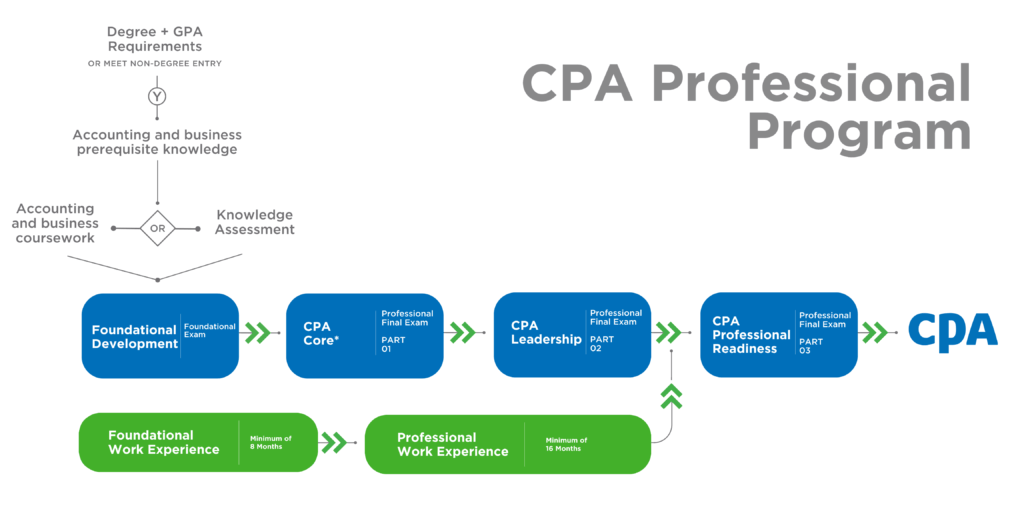

The CPA profession in Canada is updating the CPA certification pathway to align with Competency Map 2.0. These changes include updates to the CPA Professional Education Program (CPA PEP), related examinations, and practical experience requirements. Collectively, these updated components form the CPA Professional Program.

Candidates currently enrolled in the CPA Certification Program will be supported through this change during the transition period January 1, 2027, to December 31, 2028.

For the purposes of this guide, the current CPA Certification Program is referred to as the ‘current program’ and includes CPA PEP, the Common Final Examinations (CFE), and the CPA Practical Experience Requirements (PER). The CPA Professional Program is referred to as the ‘new program’ and will replace the current program following the transition period.

Note: The formal program names continue to apply for legal and administrative purposes; the terms “current program” and “new program” are used throughout this guide for readability.

Transitional policies follow a common national framework; however, the administrate and/or regulatory processes may vary by province. This guide applies to candidates enrolled in the current program in the Atlantic region.

This document is current as of the publication date and may be updated as final transitional provisions are confirmed by the relevant provincial bodies and regulatory authorities. Candidates are responsible for complying with the most current requirements.

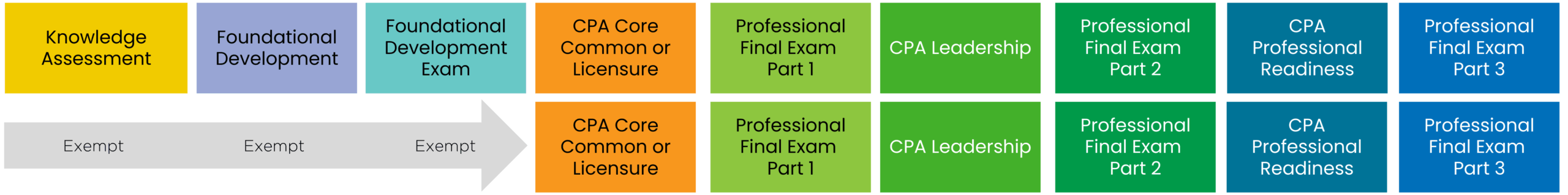

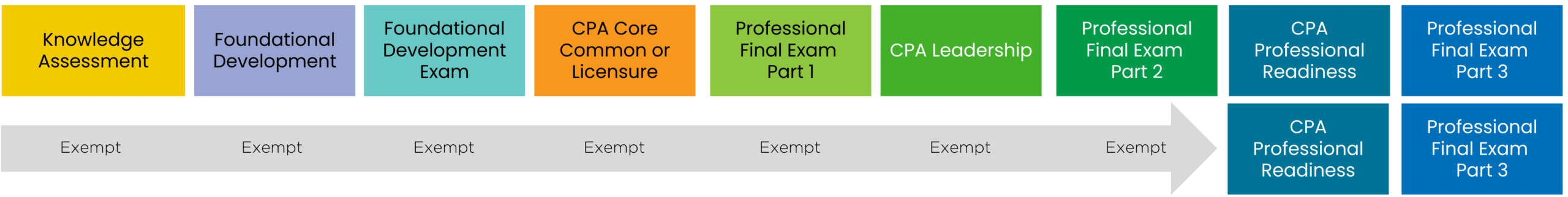

The new program will be comprised of four modules and related exams and practical experience requirements as shown in the diagram below.

How to Use This Guide

- Start with Section 1 to review the transition eligibility requirements.

- If you do not meet these requirements, read Section 2: Candidates Not Eligible to Transition.

- If you meet all eligibility requirements, read Section 3 for guidance on transitioning to the new program.

- Section 4 provides information on who to contact for questions/support.

Section 1: Transition Eligibility Requirements

Eligible candidates may transition from the current program to the new program only during the formal transition period from January 1, 2027, to December 31, 2028. Transition is not automatic and requires meeting all eligibility requirements and submitting a request to transition. Instructions relating to indicating intent to transition are expected to be available in the summer of 2026.

To be eligible to transition, a candidate must:

- Have a program time limit that ends after December 31, 2028.

- Hold active candidate status and in good standing with their provincial CPA body at the time of transition.

- Have no outstanding fees.

- All practical experience reporting submissions must be kept up to date. Eligible reports must be verified, reviewed, and approved by the profession. To ensure timely processing, all reporting must be finalized at least eight (8) weeks prior to December 31, 2028.

- Satisfy the good character requirements of the governing provincial CPA body.

- Have no outstanding penalties or unresolved disciplinary matters.

- Be in full compliance with the terms of the Training contract.

If you do not meet all transition eligibility requirements, read Section 2. You are not eligible to transition and must complete your requirements under the current program policies.

If you meet all transition eligibility requirements, read Section 3 for guidance on transitioning to the new program.

MOU Candidates: Candidates covered under a Memorandum of Understanding (MOU) are not eligible to transition under the eligibility framework described in this guide. Transition pathways and requirements for MOU candidates are governed by separate agreements and will be communicated separately.

Section 2: Candidates Not Eligible to Transition

This section applies to candidates who do not meet one or more of the eligibility requirements outlined in Section 1. This includes candidates whose current program time limit ends before December 31, 2028. Candidates in this category are not eligible to transition and must complete all remaining program requirements under the current program.

2.1 Education and Examinations

Candidates who are not eligible to transition must complete all remaining CPA PEP modules, examinations, and the Common Final Examination (CFE), where applicable, under the current program. Completion must occur within the original program time limit and is subject to the availability of remaining offerings and module/exam attempts remaining.

2.2 Program Time Limit

The original seven-year program time limit assigned at admission continues to apply. No additional time is granted to complete CPA PEP modules or current practical experience requirements as a result of the launch of the new program. Notwithstanding time limits referenced in this section, any extension of time is available only through existing current program policies (for example, approved leaves or formal time-limit extensions).

2.3 Practical Experience

Candidates not eligible to transition must complete all practical experience requirements under the current program using the Practical Experience Reporting Tool (PERT). Candidates should confirm any outstanding requirements with CPA ASB and work closely with their employer to remain on track. All reporting must be finalized and submitted to the school at least ten (10) weeks prior to contract expiry to ensure timely processing.

2.4 Extenuating Circumstances

Candidates with documented extenuating circumstances that affect program progression may be assessed on a case-by-case basis in accordance with applicable policies and human rights standards. Any approved changes do not create precedent and does not alter the general transition eligibility rules.

Section 3: Candidates Eligible to Transition

This section applies to candidates who meet all eligibility requirements in Section 1 and whose request to transition has been approved by the provincial CPA body. Candidates can choose to transition before the final offering of their next CPA PEP module or exam and will be required to transition when program offerings are no longer available. Once a transition is approved and confirmed, candidates cannot return to the current program.

3.1 Transition Pathways

Early transition may apply where you still have a viable path to complete remaining current program requirements within available offerings. In this case, you may choose to complete remaining components under the current program or apply to transition early to the new program.

Required transition applies when you cannot complete the current program because your next module or exam is no longer available.

When a candidate’s situation does not align clearly with either pathway, candidates are encouraged to reach out to the CPA Atlantic School of Business to discuss their options.

3.2 Transition Application and Approval

Eligible candidates must submit a request to transition during the transition period. No candidate will be transitioned automatically. Transition is not considered confirmed until the request to transition has been reviewed and approved. Candidates who are eligible to transition but do not apply will remain in the current program and must complete their requirements by December 31, 2028.

3.3 Voluntary Withdrawal for Candidates Who Decline Transition

Eligible candidates who choose not to transition to the new program and who will not be able to complete the current program by December 31, 2028, may request to voluntarily withdraw.

A voluntary withdrawal:

- must be formally notified by emailing programs@cpaatlantic.ca

- ends the candidate’s active status in the current program;

- does not permit re-entry into the program. If the former candidate later wishes to pursue the CPA designation, they will be required to apply under the program requirements in effect at that time; may result in no credit being granted for previously completed current-program components, depending on the policies in effect at the time of any future application.

Candidates considering voluntary withdrawal are strongly encouraged to speak with their provincial CPA body and the CPA Atlantic School of Business before submitting a request, to understand the implications of withdrawing.

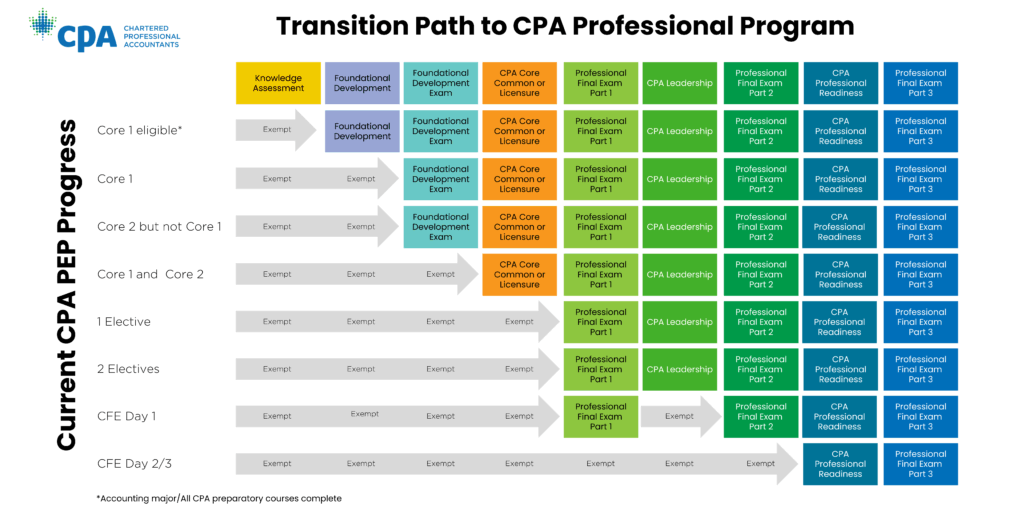

3.4 Placement in the New Program

After eligibility is confirmed and the request to transition is approved, placement in the new program will be based on education and examinations completed under the current program, and on practical experience recognized to date. Candidates who have already passed the CFE are exempt from further education and examination requirements in the new program, but must still meet other requirements, including practical experience completion within applicable timelines.

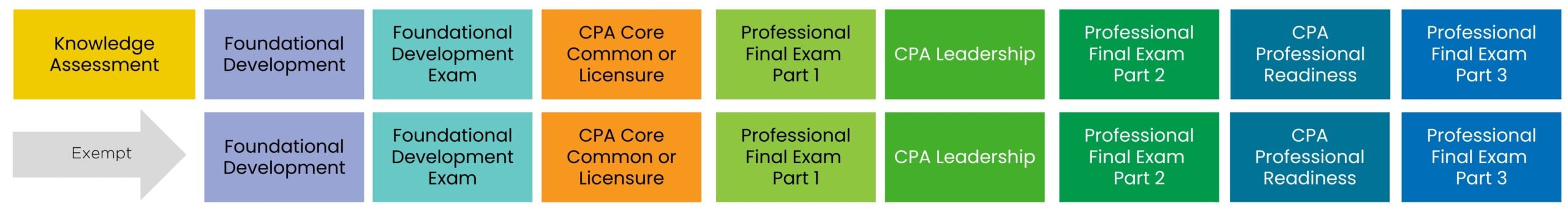

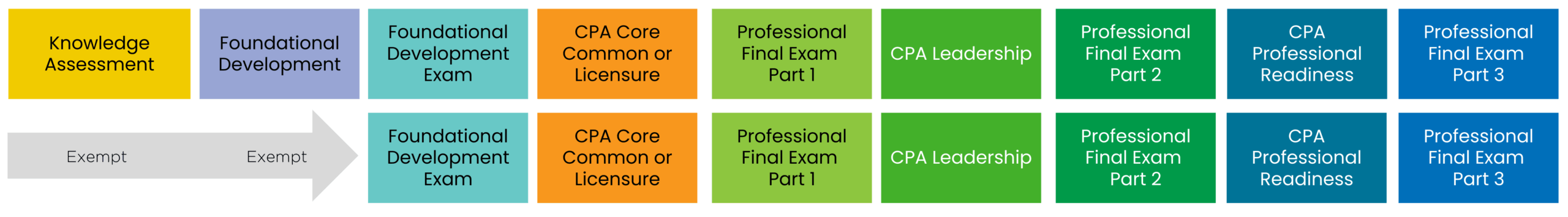

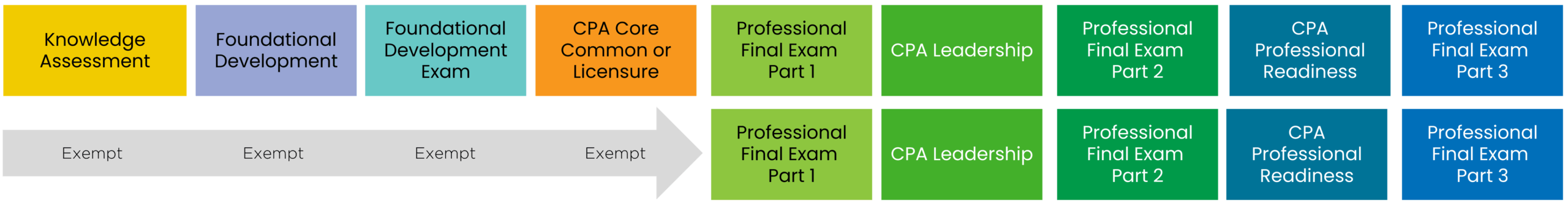

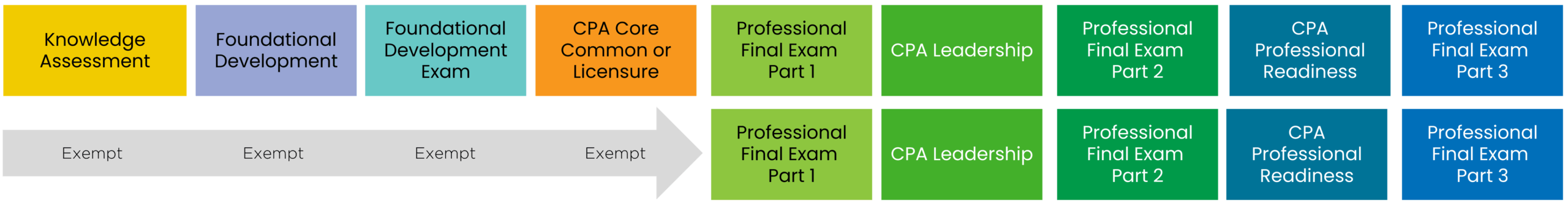

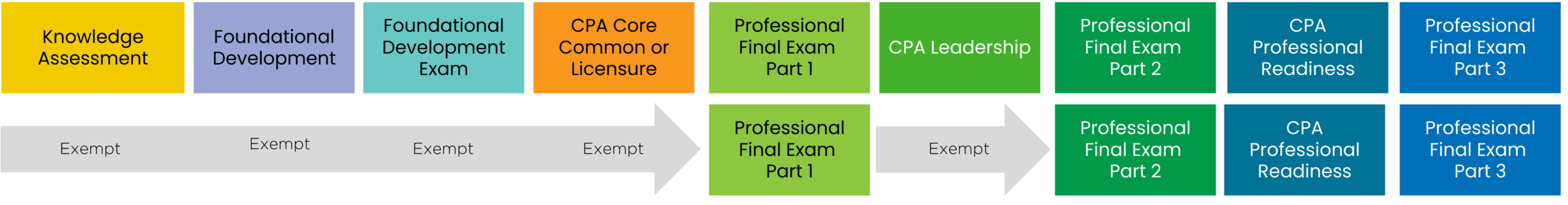

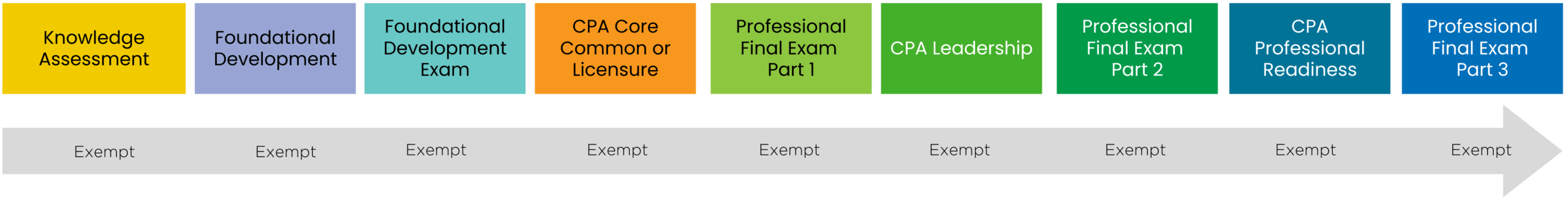

For a visual overview of CPA Professional Program components required based on CPA PEP completion, please see the below:

Click on the highest module you will have completed at the time of transition to view how your PEP progress will carry over into the new program.

Valid Transcript Assessment confirming program eligibility

CPA Professional Program Point of Entry: Foundational Development module

Core 1 eligible (All admission requirements complete)

CPA Professional Program Point of Entry: Foundational Development module

All practical experience requirements must be met before starting CPA Professional Readiness.

Note: The final offering of Core 1 starts in May 2027, with the exam in June 2027.

Core 1 or Core 2

CPA Professional Program Point of Entry: Foundational Development exam

All practical experience requirements must be met before starting CPA Professional Readiness.

Note: The final offering of Core 2 starts in July 2027, with the exam in September 2027.

Core 1 and Core 2

CPA Professional Program Point of Entry: Core Common or Core Licensure (depending on chosen path)

All practical experience requirements must be met before starting CPA Professional Readiness.

Note: The final offering of the electives starts in January 2028, with the exam in March 2028.

1 Elective

CPA Professional Program Point of Entry: Professional Final Exam I (If licensure path is selected, Core Licensure module is required)

All practical experience requirements must be met before starting CPA Professional Readiness.

Learners intending to pursue a career in public accounting must complete CPA Core – Licensure.

Note: The final offering of the electives starts in January 2028, with the exam in March 2028.

2 Electives

CPA Professional Program Point of Entry: Professional Final Exam I (Exempt from Core Common module)

All practical experience requirements must be met before starting CPA Professional Readiness.

If CPA PEP Tax and Assurance are complete: Exempt from CPA Core Licensure.

Any other combination of electives complete: Exempt from CPA Core Common.

Note: The final offering of Capstone 1 starts in May 2028, with the presentation in July 2028. The final offering of Capstone 2 starts in July 2028.

CFE Day 1 Only

CPA Professional Program Point of Entry: Professional Final Exam I (Exempt from Core Common or Core Licensure, depending on chosen path; exempt from CPA Leadership module)

All practical experience requirements must be met before starting CPA Professional Readiness.

Note: The final offering of the CFE is in September 2028.

CFE Day 2/3 Only

CPA Professional Program Point of Entry: CPA Professional Readiness module (Exempt from Core Common module, Professional Final Exam I and II)

All practical experience requirements must be met before starting CPA Professional Readiness.

Note: The final offering of the CFE is in September 2028.

CFE All Days

If you have passed all days of the CFE, you do not need to transition education or exams. You may need to transition practical experience, depending on how much you have completed.

Practical experience partially met

CPA Professional Program – Point of Entry : Eligible for recognition upon reassessment

Practical experience fully met

CPA Professional Program – Point of Entry : Meet applicable education requirements

Practical experience fully met CFE all days and practical experience met

Transition not required

*all dates and information are subject to change.

3.5 Program Time Limit After Transition

Candidates who transition to the new program may receive up to three additional years added to their remaining current program time limit, provided that the overall time limit in the new program does not exceed seven years.

This additional time:

- Applies only to candidates who are approved to transition.

- Is intended to support completion of remaining requirements under the structure of the new program.

- Cannot result in a total time limit in the new program exceeding seven (7) years from the date of admission into the new program (see transition table in section 3.3 for details).

Time already elapsed in the current program counts towards the overall seven-year limit; the additional time granted to candidates who transition to the new program is to facilitate program completion within the new-program framework.

Candidates have three attempts per module and per challenge exam in the new program, regardless of any prior attempts in the current program.

3.6 Fees, Accommodations, and Professional Conduct

Candidates transitioning to the new program will not be required to pay fees twice for the same requirement. For example, candidates will not pay for modules or exams from which they are exempt. Any annual fees already paid within the academic year in which a candidate transitions will continue to apply and will not be charged again. The fee schedule for the new program will be published once available, and candidates will be notified through official communication channels.

All existing ongoing exam accommodations will be transferred to the new program. If applicable, accommodations may be re-evaluated later. Candidates who do not have approved accommodations at the time of transition will be required to follow the new accommodation application process.

Professional conduct and academic integrity requirements continue to apply throughout all stages of a candidate’s lifecycle. Conduct records and conditions carry forward. Candidates with outstanding penalties or conditions (for example, suspensions or required ethics coursework) must fulfill all requirements before transition approval.

*all dates and information are subject to change.

Section 4: Support and Contact Information

For questions related to transition eligibility, transition applications, or next steps, candidates should contact the CPA Atlantic School of Business at transition@cpaatlantic.ca.