Introducing the CPA Professional Program

The CPA profession in Canada is updating the CPA certification program. This includes refreshing the CPA Professional Education Program (CPA PEP), its exams, and the practical experience requirements. Collectively, these re-imagined components form the CPA Professional Program.

While we anticipate that most candidates currently enrolled in CPA PEP will have an opportunity to finish the program, there is a transition plan to the CPA Professional Program for those who are unable to complete their current program.

Program Overview

The CPA Professional Program prepares you to lead across industries. It blends essential technical excellence in accounting and a strong grounding in ethics with real-world experience and future-focused skills that evolve alongside the demands of an ever-changing economy and international standards.

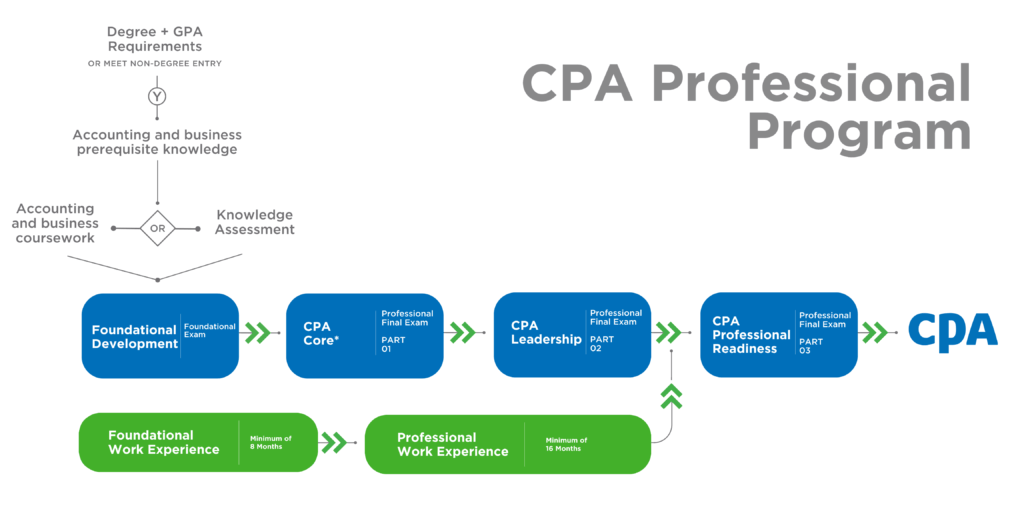

Your Journey Through the CPA Professional Program

You will move through the CPA Professional Program step by step, completing each module in order, and you must pass each one before writing the associated final exam.

Admissions Requirements

The academic admission requirements for the CPA Professional Program are summarized as follows and described in detail here:

All learners must meet the following criteria:

- A degree or equivalent.

- Completion of at least 120 credit hours of post-secondary education.

- A minimum GPA of 65%.

- Good character.

- Lawful permission to study and/or work in the registered province/region.

To be eligible to enter the CPA Professional Program directly at the Foundational Development Module and receive exemption from the Knowledge Assessment, learners must meet the above criteria in addition to the following:

- Complete a minimum of 45 credit hours in accounting or business courses from a post-secondary institution(s), the CPA preparatory courses, or a combination of both.

- At least 21 of those credit hours cover the following required topic areas

-

-

- Intermediate Financial Reporting

- Advanced Financial Reporting

- Intermediate Management Accounting

- Finance

- Assurance

- Taxation

-

-

- The remaining 24 credit hours may be any accounting or business-related courses

- At least one course among the 45 required topic area credit hours must have been completed within five years of admission, demonstrating recent academic engagement in the field.

Pre-requisite knowledge may be acquired as part of, or in addition to, the 120-credit-hour degree as follows: In accounting or business courses from a post-secondary institution(s), the CPA preparatory courses, or a combination of both.

Applicants who do not meet the required accounting coursework requirements (including currency education) will have the option to demonstrate their accounting and business competencies by passing the Knowledge Assessment before entering the CPA Professional Program at the Foundational Development module or by meeting the remaining admission requirements at a post-secondary institution.

For detailed information regarding the admission process and requirements, please refer to our Academic Admission Requirements page.

Prerequisite Knowledge

Before entering the CPA Professional Program at the Foundational Development module, applicants need to demonstrate accounting and business knowledge so that they are positioned for success in the program. Accounting and business knowledge can be demonstrated by either completing 45 credit hours in accounting and business as part of or in addition to a 120-credit-hour degree from a Canadian or international post-secondary institution or by passing the Knowledge Assessment.

Additional information about the prerequisite knowledge requirements will be available in 2026.

Foundational Development Module

In the first module of the CPA Professional Program, you will build your Specific, Foundational, and Sub-foundational Competencies and begin developing your CPA Advanced Professional Competencies. You will also start integrating the Foundational Common Core and developing your CPA Ethical Mindset, including human values, skills, and professional competencies.

You may begin reporting your practical experience when you start this module.

After passing this module, you will need to pass the Foundational Development Exam before moving onto CPA Core.

CPA Core Module

Next, you will choose between two versions of the CPA Core module:

- CPA Core – Common: This version strengthens your Specific Competencies in areas like financial reporting, assurance and trust, big data and analytics, and taxation. You will also continue developing your CPA Advanced Professional Competencies.

- CPA Core – Licensure: If you are intending to pursue a career in public accounting, you must complete this version of CPA Core. It includes all components of CPA Core – Common, with additional depth in financial reporting, assurance and trust, big data and analytics, non-financial reporting, and taxation.

After passing this module, you will be eligible to write Professional Final Exam Part 1. There are two versions of the exam, and you will write the version that corresponds to the version of the module you pass.

CPA Leadership Module

Here, you will take your CPA Ethical Mindset and CPA Advanced Professional Competencies to the next level. You will apply decision-making processes to real-world CPA challenges, integrating all your competencies across topics. This module focuses heavily on developing your ethical mindset, critical thinking and CPA Advanced Professional Competencies.

After passing this module, you will be eligible to write Professional Final Exam Part 2. You will need to pass Professional Final Exam parts 1 and 2 and complete all practical experience requirements before moving onto the next module.

Practical Experience

You will need to complete a minimum of 24 months of work experience, consisting of:

- Up to 8 months of Foundational Experience: Hands-on work where you begin applying your knowledge.

- At least 16 months of Professional Experience: More advanced work, focused on developing decision-making skills.

Work plans must be submitted and approved by the profession before you report your experience. You are required to meet all Practical Experience requirements before starting the Professional Readiness Module. Time off, such as vacation or holidays, and leaves of absence do not count toward your 24-month experience duration.

CPA Professional Readiness Module

Before you can take this module, you must have met all practical experience requirements.

This module is where you will strengthen your CPA Ethical Mindset and build your CPA Advanced Professional Competencies through both self-study and five-days of interactive case-based learning. You will explore what it means to be a CPA professional, understand the CPA Code of Conduct, work effectively in teams, and tackle emerging global, social, and technological issues.

After passing this module, you will be eligible to write Professional Final Exam Part 3. After passing Professional Final Exam Part 3, you can apply for CPA membership in your province. Once you become a member, you can use the CPA designation.

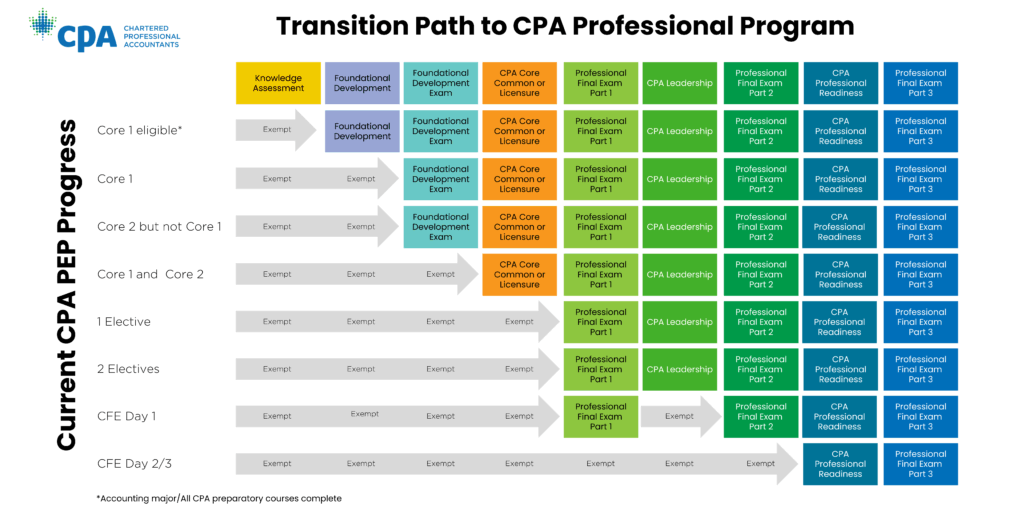

Current CPA PEP candidates

Most candidates currently enrolled in CPA PEP will have an opportunity to finish the program. However, there is a transition plan to the CPA Professional Program for those who are unable to complete their current program. Over the next few years, current CPA PEP candidates will have decisions to make on how to proceed:

Stay the course: There is no requirement to transition to the new program if you are on track to complete the existing program. Note, the last CFE offering will take place in September 2028. If you do not complete the existing requirements before the transition deadline you will need to transition to the new program to become a CPA.

Transition: There will be a transition period from January 2027 to December 2028 for candidates who will be unable to complete CPA PEP before the final CFE in September 2028. If you are in good standing, you may be able to transition your education, experience, or both to the CPA Professional Program.

For more information on transitioning to the new CPA Professional program, click here.

If you transition your education, CPA PEP modules or exams that you successfully complete will count towards exemptions from equivalent modules or exams in the new CPA Professional Program. However, anyone who transitions education to the CPA Professional Program must, at a minimum, complete the Professional Readiness module and the Professional Final Exam 3.

If you transition your experience, recognized experience under the existing program will be assessed to determine experience requirements from the new program you will need to meet.

What to know:

- Existing policies remain in place for CPA PEP and CPA preparatory courses.

- There will be two CFE offerings after the CPA Professional Program launches in early 2027: September 2027 and September 2028.

- If you transition to the CPA Professional Program, you will have three attempts at new program exams regardless of how many attempts you have remaining in the existing program.

- If you transition to the CPA Professional Program, you must complete CPA Professional Program requirements. You cannot return to CPA PEP.

- The current and future CPA certification programs provide the skills CPA candidates need to be successful.

Current and Future CPA preparatory course students

CPA Atlantic School of Business is currently in the process of finalizing a contract to extend PREP at a regional level for an additional year, with the final semester ending in December 2027. We expect to make an announcement in the coming weeks.

Future CPA PEP candidates

January 2027 is the final opportunity to begin Core 1 and complete all CPA PEP education and examination components within the remaining offerings, assuming steady progression and passing all modules and exams on the first attempt. If you are unable to complete CPA PEP by December 31, 2028, you will be required to transition to the CPA Professional Program.

Employers

Employers have a unique relationship with learners, providing supportive environments so learners can meet the practical experience requirements. If you have any questions, please don’t hesitate to email practicalexperience@cpaatlantic.ca

Key Dates

- Last Spring CFE: June 2026

- Last Core 1 module: January – March 2027

- Last Fall CFE: September 2028

- Final date to complete Practical Experience requirements in PERT: December 2028

*all dates are subject to change.

Transition Overview

Candidates transitioning to the CPA Professional Program may receive recognition for the learning and experience they have successfully completed in CPA PEP. Please note, existing CPA PEP policies remain in place for CPA PEP candidates until they complete the program or transition to the CPA Professional Program.

For a detailed overview of the transition, please review our CPA Professional Program Transition Guide for Current Candidates.

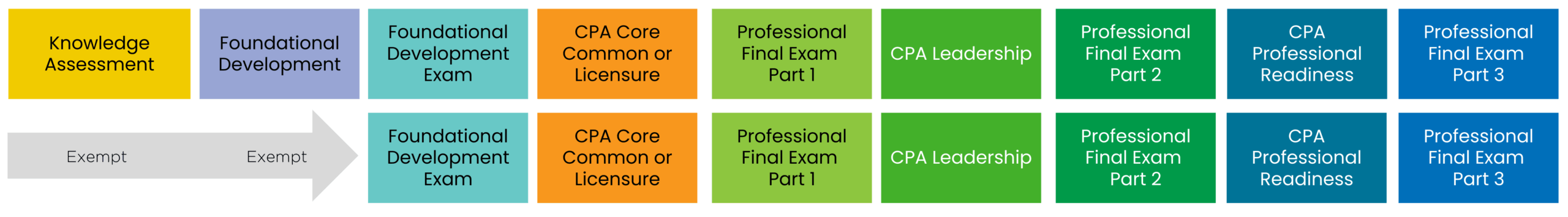

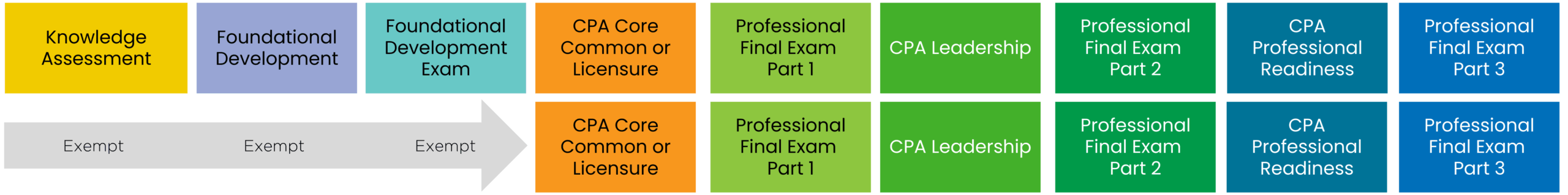

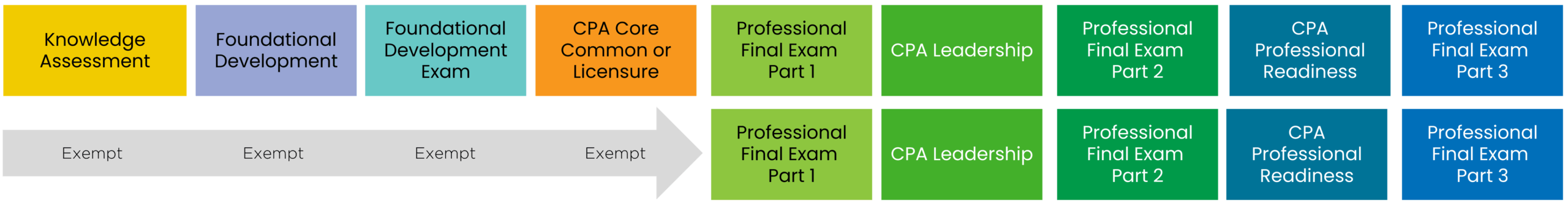

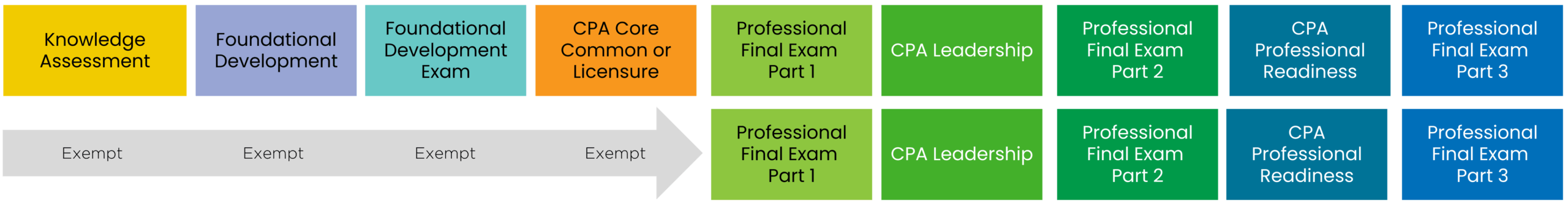

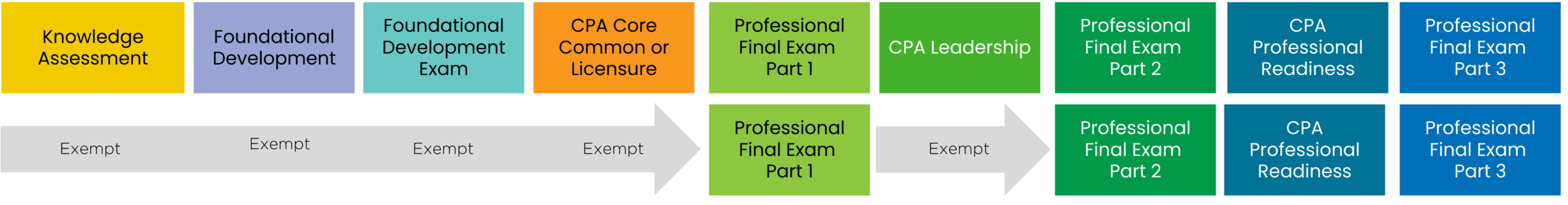

TRANSTION GUIDE FOR THE NEW CPA PROFESSIONAL PROGRAMFor a visual overview of CPA Professional Program components required based on CPA PEP completion, please see the below:

Click on the highest module you will have completed at the time of transition to view how your PEP progress will carry over into the new program.

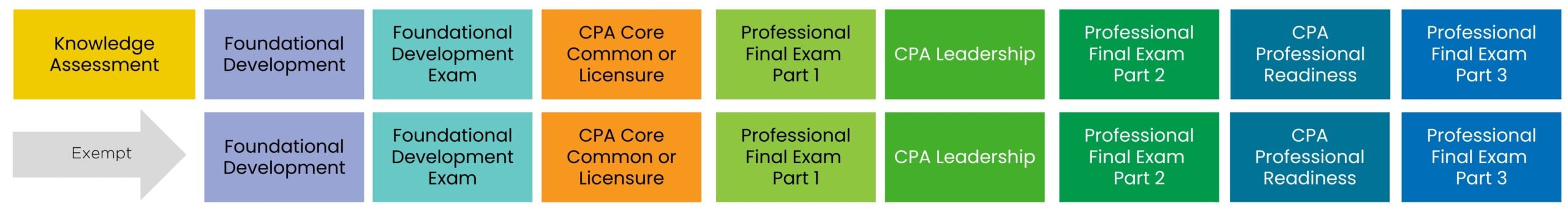

Core 1 eligible (All admission requirements complete)

All practical experience requirements must be met before starting CPA Professional Readiness.

Note: The final offering of Core 1 starts in May 2027, with the exam in June 2027.

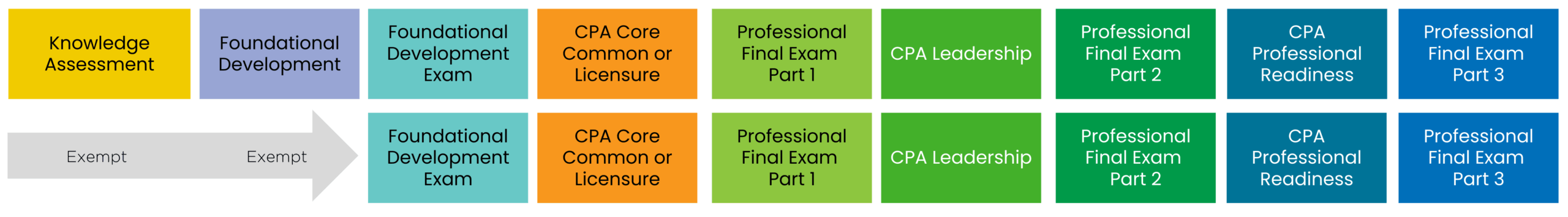

Core 1

All practical experience requirements must be met before starting CPA Professional Readiness.

Note: The final offering of Core 2 starts in July 2027, with the exam in September 2027.

Core 2 but not Core 1

All practical experience requirements must be met before starting CPA Professional Readiness.

Note: The final offering of Core 1 starts in May 2027, with the exam in June 2027.

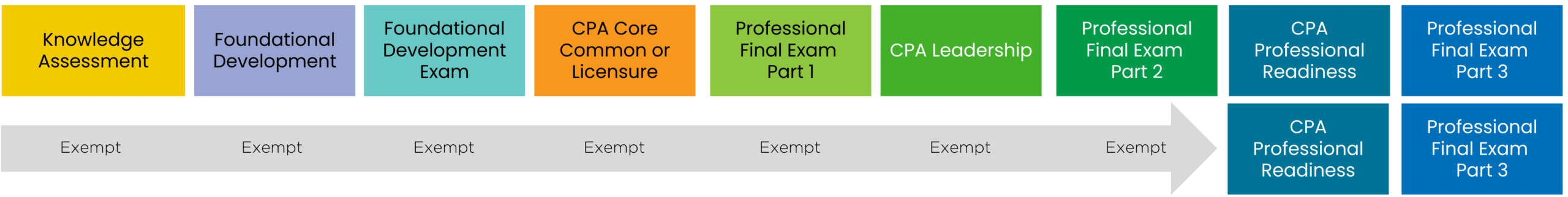

Core 1 and Core 2

All practical experience requirements must be met before starting CPA Professional Readiness.

Note: The final offering of the electives starts in January 2028, with the exam in March 2028.

1 Elective

All practical experience requirements must be met before starting CPA Professional Readiness.

Learners intending to pursue a career in public accounting must complete CPA Core – Licensure.

Note: The final offering of the electives starts in January 2028, with the exam in March 2028.

2 Electives

All practical experience requirements must be met before starting CPA Professional Readiness.

If CPA PEP Tax and Assurance are complete: Exempt from CPA Core Licensure.

Any other combination of electives complete: Exempt from CPA Core Common.

Note: The final offering of Capstone 1 starts in May 2028, with the presentation in July 2028. The final offering of Capstone 2 starts in July 2028.

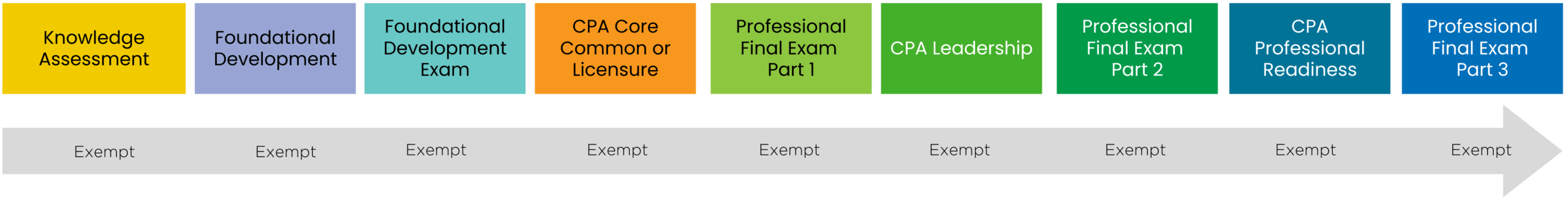

CFE Day 1 Only

All practical experience requirements must be met before starting CPA Professional Readiness.

Note: The final offering of the CFE is in September 2028.

CFE Day 2/3 Only

All practical experience requirements must be met before starting CPA Professional Readiness.

Note: The final offering of the CFE is in September 2028.

CFE All Days

If you have passed all days of the CFE, you do not need to transition education or exams. You may need to transition practical experience, depending on how much you have completed.

*all dates and information are subject to change.

Practical Experience

If you transition your experience, recognized experience under the existing program will be assessed to determine the experience requirements from the new program you will need to meet.

Additional information about practical experience will be provided in 2026. Your provincial CPA body will have additional information about transitioning your experience.

FAQs

Is the new program easier or harder than the current CPA program?

The CPA Professional Program is different from the current program. It is being developed to meet the standards set out in Competency Map 2.0 and uphold the rigour of the CPA profession.

What is the Knowledge Assessment? What is required to write it? How will I know if I am prepared? Why is there a Knowledge Assessment Exam?

The Knowledge Assessment assesses whether you have the prerequisite knowledge to position you for success in the program. If you hold 45 credit hours in accounting and business as part of or in addition to a 120-credit-hour degree from a Canadian or international post-secondary institution and meet the other admission requirements, you are exempt. Otherwise, you will need to demonstrate accounting and business competencies by passing this assessment before starting the program. People without this perquisite knowledge will struggle to be successful in the new CPA Professional Program. Practice exams will be available. Additional information will be provided in 2026.

What’s the structure of the new program?

The CPA Professional Program consists of four modules, exams, and a practical experience component.

Will there still be a CFE?

The new CPA Professional Program will include three comprehensive, summative examinations keeping with the current practice of incorporating cases to test the competencies of anyone on the path to the CPA. This was informed through comprehensive research across accounting bodies and other professions around the world to examine best practices and modern approaches as well as looking at the latest pedagogical methods.

When will the CPA preparatory courses end? What happens if I don’t finish my courses before then?

The national CPA preparatory program will be offered through December, 2026. The CPA Atlantic School of Business is currently in the process of finalizing a contract to extend PREP at a regional level for an additional year, with the final semester ending in December, 2027.

We expect to make an announcement in the coming weeks.

Students who have successfully met the degree and GPA admission requirements for the CPA Professional Program but have not completed all coursework requirements will be eligible for the following options:

Complete the remaining courses at a post-secondary institution (PSI) and enter the CPA Professional Program Foundational Module directly.

Pass the Knowledge Assessment to gain entry to the CPA Professional Program Foundational Module.

If I finish my CPA preparatory courses before the transition deadline, can I skip the Knowledge Assessment?

Yes. If you complete the CPA preparatory courses before the transition deadline and meet the other admission requirements, you are exempt from the Knowledge Assessment and can enter Foundational Development.

What is covered on each exam?

Details about the exam structure will be provided in 2026.

When do I need to transition?

You can–and we recommend that you do–continue in the current program until the module or exam you require is no longer offered, at which point you will need to transition to the new program. Everyone must transition by December 2028. For example, if you do not pass Core 2 by its final offering, you will need to transition to the new program.

When is the last CFE? Will there be a CFE in May?

There will be a May CFE in 2026. In 2027 and 2028, there will be one CFE written in September of each year. The September 2028 CFE is the final one.

Will the exams be the same across Canada?

Yes, the exams will be consistent across the country.

*all dates and information are subject to change.